Geared towards portfolio managers and intellectually curious analysts our strategy offering is data centric and combines a top down global macro framework with bottoms-up data. This approach is designed to capture inflection points more quickly, particularly in more cyclically geared industries. The data sets include hard to find and expensive to procure, as well as more traditionally utilized metrics. The bottoms-up is aided by a global network of private companies, particularly those at the beginning and end of the supply chain – where real time market color can prove most valuable. The intent of the product is to identify material shifts in macro conditions and measure increases or decreases in risk by sector or sub-sector.

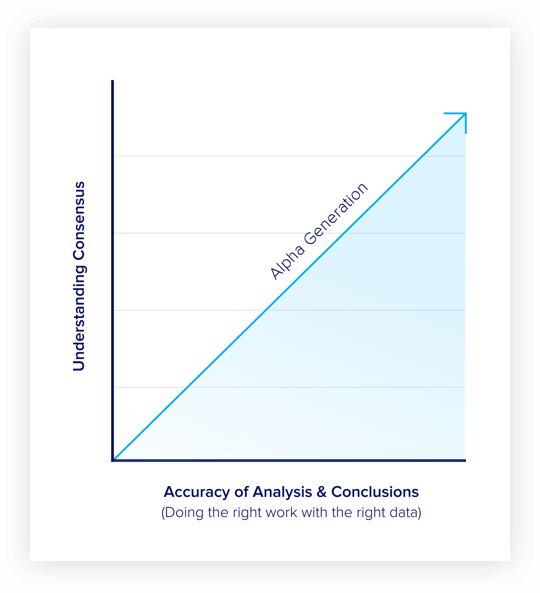

Right Work + Right Data

We see two categories of mistakes one can make in the investment selection process: errors of omission and errors of judgement. Errors of omission are caused by doing the wrong work, or not doing the work at all. Errors of judgement come from inaccurately forecasting how the market will respond to results or a data set. Our work is focused on doing the right work with the right data, and therefore, is intended to decrease the odds of failure of omission. If we can maximize accuracy of the first variable, then minimizing errors of judgement can simply boil down to understanding sentiment – a variable largely solved by listening more than talking.